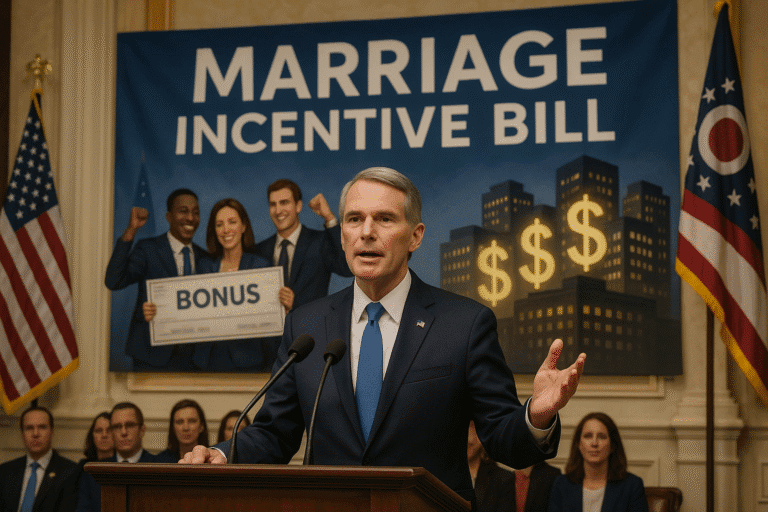

Ohio, USA – In a remarkable move to revive family values and encourage marriage, a US lawmaker in Ohio has introduced a bill. This bill would give companies huge tax incentives if they offer financial rewards to married employees.

The bill, called the “Marriage Investment Act,” provides an annual nonrefundable tax deduction of up to $50,000. This deduction is intended for employers who implement what is known as a “qualified marriage bonus policy.” Under this policy, companies receive a $1,000 deduction for each employee who receives a marriage bonus of at least that amount.

The law requires employers to verify marriage by providing an official marriage license or marriage record. It also allows unused tax credits to be carried forward for up to five years.

Republican Representative Josh Williams, the bill’s lead sponsor, explained that the goal is to engage employers in supporting family formation. It also aims to encourage young people to marry. The representative noted that studies have shown raising children in single-parent households has negative effects on society. This is especially true with single mothers.

Williams added that the law comes in response to what he described as the “marriage penalty” embedded in some public assistance programs. He believes it discourages families from staying married. He emphasized, “We thought of a new way to encourage marriage here in Ohio, and we wanted employers to be part of that incentive.”